How Paul B Insurance Medicare Part D Huntington can Save You Time, Stress, and Money.

Table of ContentsHow Paul B Insurance Medicare Advantage Agent Huntington can Save You Time, Stress, and Money.Some Known Factual Statements About Paul B Insurance Medicare Advantage Agent Huntington A Biased View of Paul B Insurance Medicare Health Advantage HuntingtonGetting The Paul B Insurance Medicare Part D Huntington To WorkWhat Does Paul B Insurance Medicare Agency Huntington Mean?

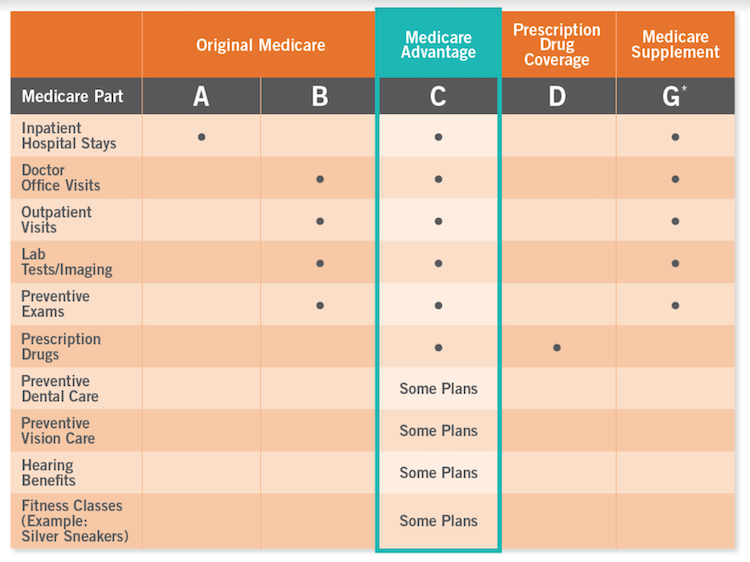

(People with specific impairments or health and wellness conditions may be eligible before they turn 65.) It's designed to protect the health and well-being of those that utilize it. The 4 components of Medicare With Medicare, it's vital to recognize Components A, B, C, and also D each component covers particular services, from clinical treatment to prescription drugs.

If you're already obtaining Social Security advantages, you'll immediately be signed up in Part An as quickly as you're qualified. Discover when to enroll in Medicare. You can obtain Component A at no charge if you or your partner paid right into Medicare for a minimum of 10 years (or 40 quarters).

How Paul B Insurance Medicare Advantage Plans Huntington can Save You Time, Stress, and Money.

Medicare Benefit is an all-in-one strategy that bundles Initial Medicare (Component An as well as Component B) with fringe benefits. Kaiser Permanente Medicare health plans are instances of Medicare Benefit plans. You require to be enrolled in Part B as well as eligible for Component A prior to you can sign up for a Medicare Advantage plan.

Before we discuss what to ask, allow's speak about who to ask. There are a lot of ways to authorize up for Medicare or to obtain the info you need prior to picking a strategy. For lots of, their Medicare journey starts straight with , the main internet site run by The Centers for Medicare and also Medicaid Providers.

Indicators on Paul B Insurance Medicare Supplement Agent Huntington You Need To Know

It covers Component A (medical facility insurance policy) and also Part B (medical insurance). These plans work as an alternate to Original Medicare, integrating the insurance coverage alternatives of Components An and B, as well as additional benefits such as dental, vision and prescription medication protection (Part D).

Medicare Supplement plans are a wonderful addition for those with Original Medicare, helping you cover expenses like deductibles, coinsurance and copays. After receiving care, a Medicare Supplement plan will pay its share of what Original Medicare didn't cover then you'll be in charge of whatever remains. Medicare Supplement plans usually don't include prescription medication protection.

You can enroll in a different Component D strategy to include medication protection to Original Medicare, a Medicare Expense plan or a few various other kinds of strategies. For numerous, this is typically the click to investigate first inquiry taken into consideration when looking for a Medicare strategy. The cost of Medicare differs relying on your health and wellness care demands, monetary support eligibility and also exactly how you choose to obtain your benefits.

How Paul B Insurance Medicare Advantage Plans Huntington can Save You Time, Stress, and Money.

For others like seeing the physician for a remaining sinus infection or filling up a prescription for protected antibiotics you'll pay a cost. The quantity you pay will certainly be various depending on the type of strategy you have as well as whether or not you have actually taken care of your deductible. Medicine is a vital part of treatment for many individuals, especially those over the age of 65.

, as well as protection while you're taking a trip locally. If you intend on taking a trip, make certain to ask your Medicare expert concerning what is and also isn't covered. Possibly you have actually been with your existing medical professional for a while, and you want to maintain seeing them.

Lots of people that make the switch to Medicare continue seeing their regular doctor, but also for some, it's not that easy. If you're dealing with a Medicare advisor, you can ask them if your doctor will remain in connect with your brand-new strategy. If you're looking at plans separately, you may have to click some web links and also make some telephone calls.

Paul B Insurance Local Medicare Agent Huntington Things To Know Before You Buy

gov website to seek out your existing physician or another carrier, center or medical facility you intend to utilize. For Medicare Benefit plans and also Expense strategies, you can call the insurance provider to ensure the physicians you desire to see are covered by the plan you want. You can likewise check link the plan's website to see if they have an on-line search tool to locate a protected physician or look here facility.

Which Medicare plan should you go with? That's the very best part you have options. And also eventually, the option depends on you. Remember, when starting, it's essential to make certain you're as educated as possible. Begin with a list of considerations, ensure you're asking the right concerns and begin concentrating on what kind of plan will best offer you and your requirements.

Medicare Advantage plans are private insurance policies that aid with the voids in Medicare insurance coverage. They appear comparable to Medigap strategies, don't puzzle the two, as they have some notable distinctions.